Our Vision

At djtradingbull, our vision is to create a seamless and efficient trading experience for our customers. As more individuals embrace online trading to manage their investments and make informed financial decisions, we are dedicated to providing an intuitive and user-friendly platform. Our goal is to enable customers to effortlessly buy, sell, and trade stocks, bonds, and other assets, ensuring a convenient and reliable trading environment that empowers them on their financial journey.

Empowering customers with the necessary knowledge and tools to make informed investment decisions lies at the core of djtradingbull vision. This entails granting access to real-time market data, robust research and analysis tools, as well as comprehensive educational resources. By equipping customers with these resources, an online trading company facilitates smart investment choices and empowers individuals to achieve their financial objectives.

Transparency and trust are fundamental pillars in the vision of djtradingbull. To establish and maintain trust with customers, the company prioritizes transparency in disclosing fees, commissions, and other charges. Additionally, djtradingbull is dedicated to providing clear and accurate information regarding the risks associated with various investment products. By fostering a culture of transparency and trustworthiness, the company aims to cultivate long-term relationships with its customers and earn their unwavering loyalty.

To realize its vision, djtradingbull places a strong emphasis on innovation and technology. This entails substantial investments in cutting-edge technologies to enhance the customer experience and streamline the trading process. For instance, the company leverages artificial intelligence and machine learning algorithms to analyze market data and provide valuable investment recommendations. Furthermore, djtradingbull explores the integration of blockchain technology to enhance the security and transparency of its trading platform, showcasing its commitment to staying at the forefront of technological advancements in the industry.

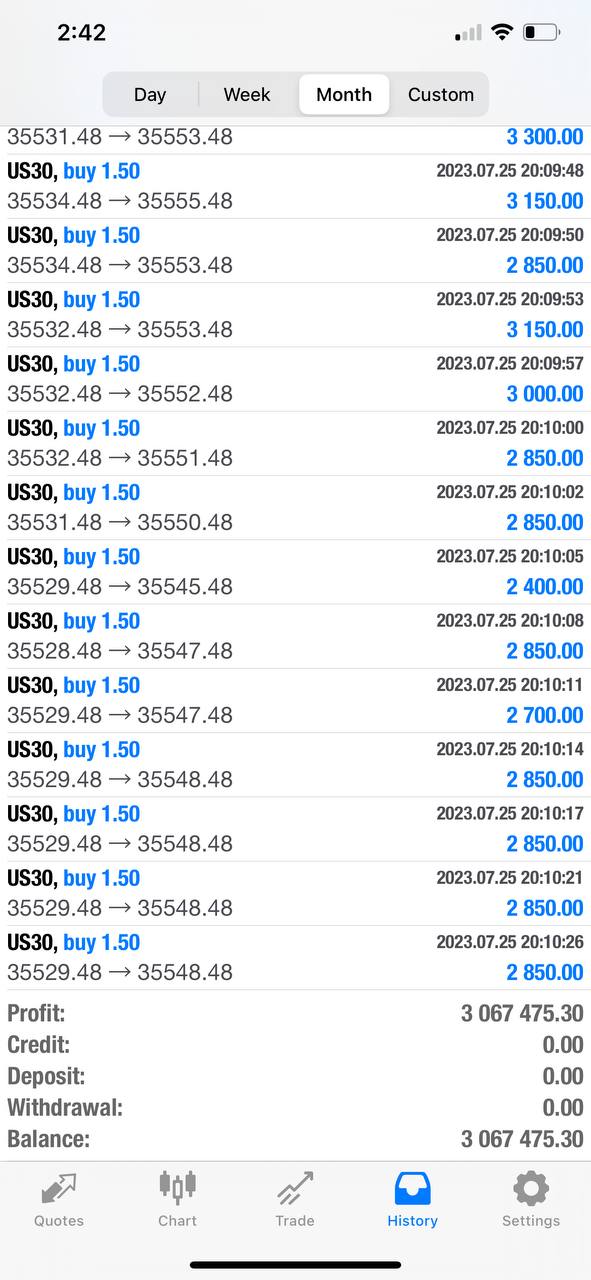

The overarching vision of djtradingbull is to empower customers and enable them to seize control of their financial future. This entails delivering a platform that offers a seamless and user-friendly trading experience. By providing customers with real-time market data, research tools, and fostering transparency and trust, djtradingbull seeks to support customers in accomplishing their financial objectives and constructing sustainable wealth over the long term. Through a commitment to innovation and technology, the company aspires to facilitate customer success and assist them in achieving their financial goals.

Our Mission

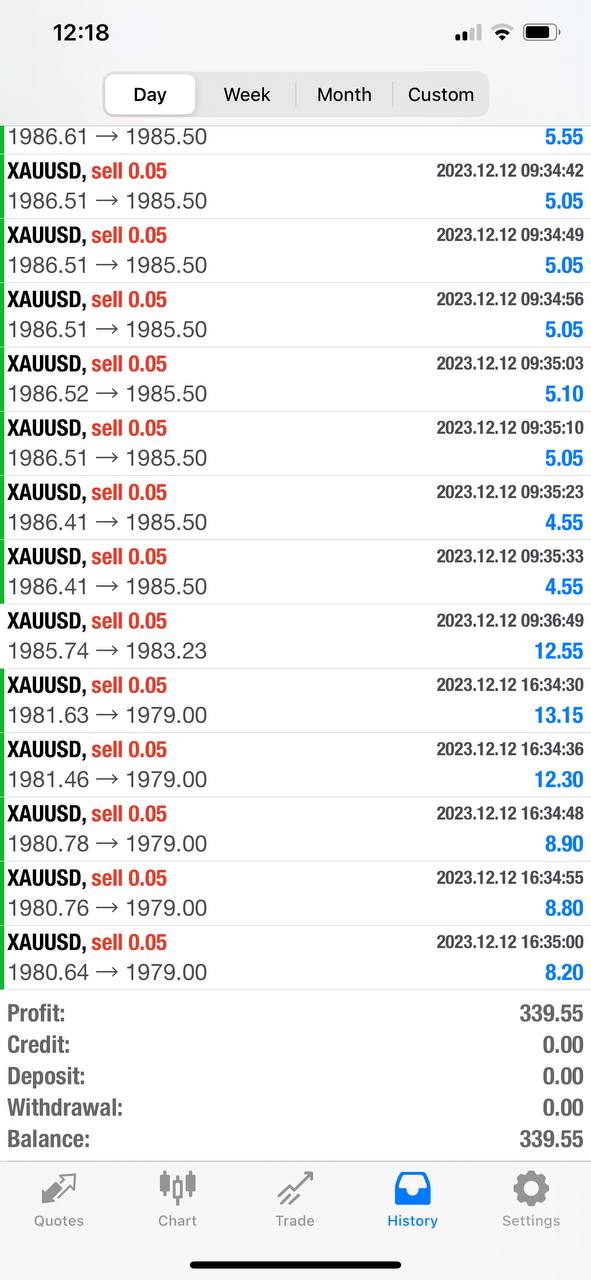

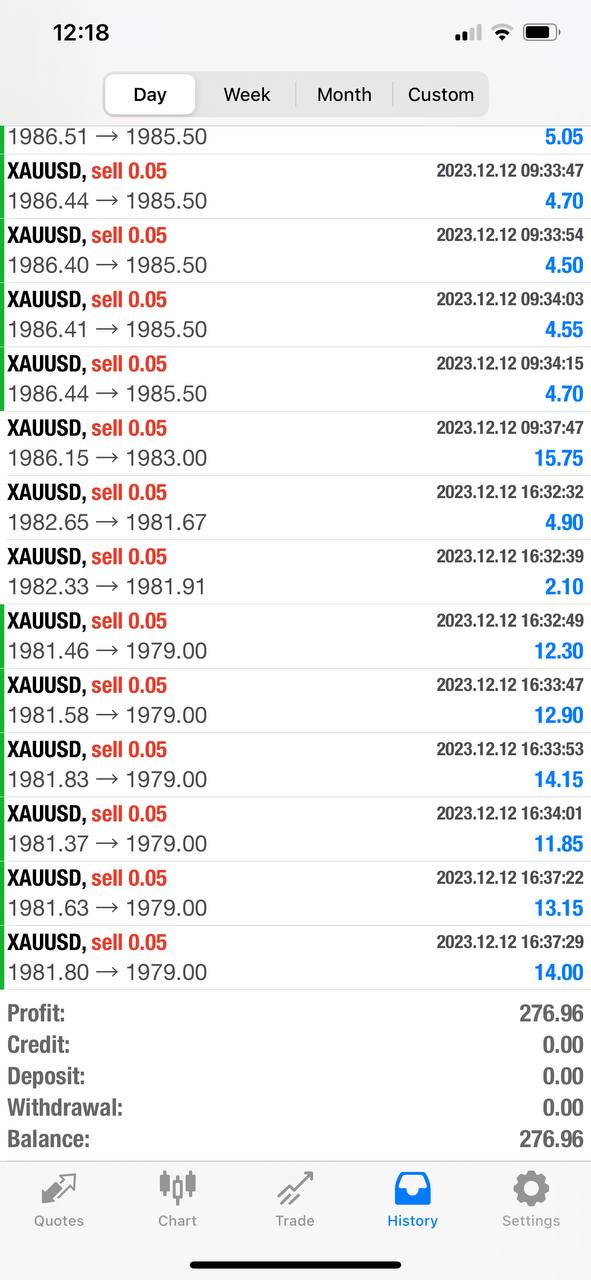

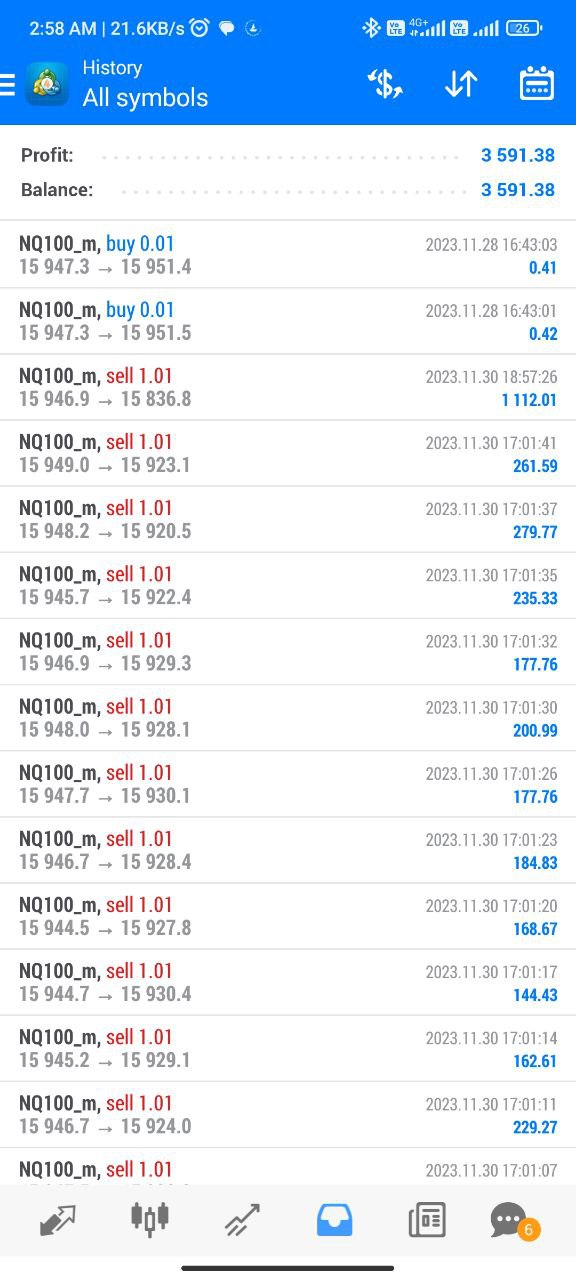

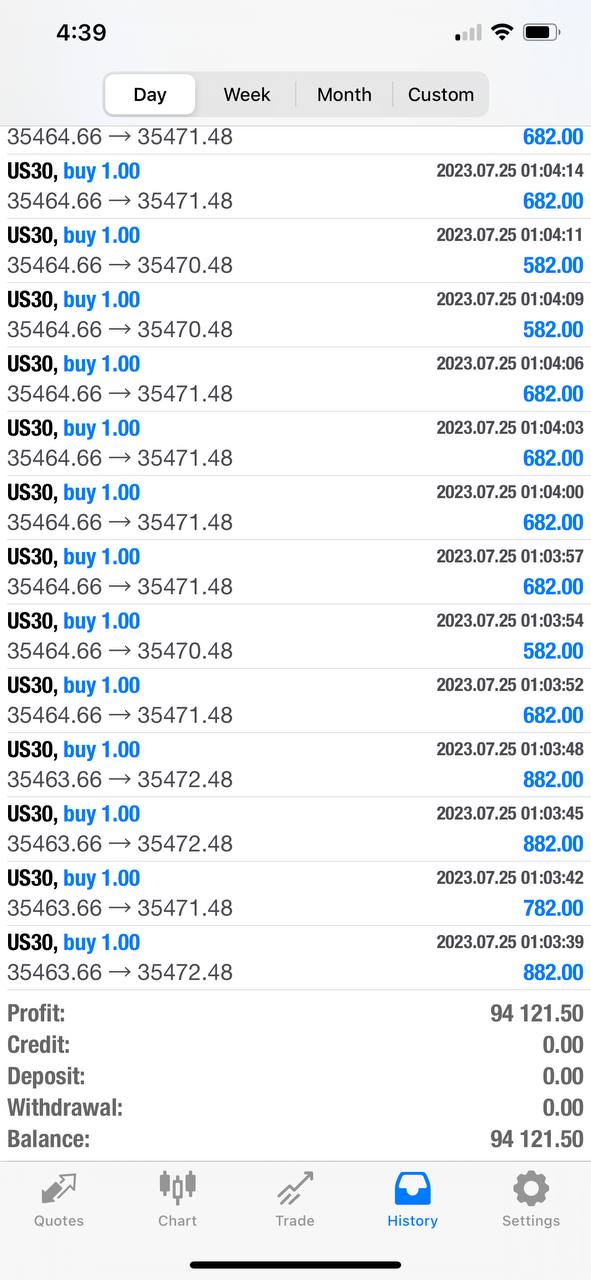

To achieve consistent profitability and sustainable growth while prioritizing risk management and preserving the capital of our clients. We aim to provide superior trading services, leveraging our expertise, market knowledge, and advanced technology. By continuously adapting to market conditions and employing sound trading strategies, we strive to deliver exceptional returns and exceed the expectations of our clients.